This PhilHealth Contribution Calculator is a free online tool you can use to easily compute your monthly contribution to PhilHealth.

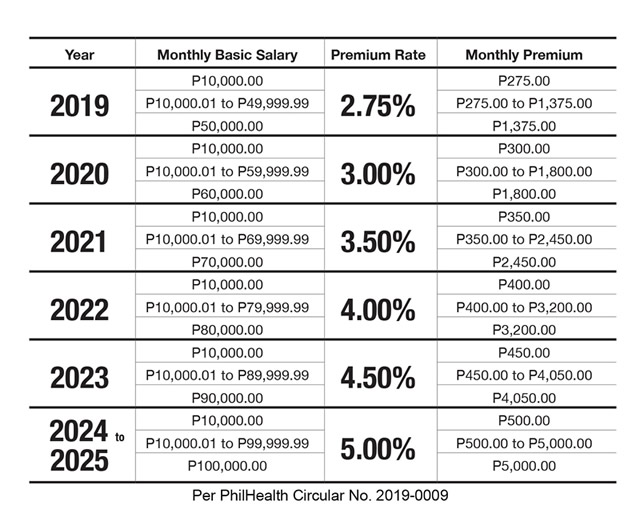

We are using the latest PhilHealth Contribution Table 2025 to derive the right result for you.

How to Use the PhilHealth Contribution Calculator

Manually computing your personal PhilHealth contribution is not that hard because there's already a easy to understand contribution table provided by PhilHealth.

However, if you want a quick tool to figure it out, use this PhilHealth Contribution Calculator instead. Here are the few steps to its usage:

- The first thing you need to enter is your

Monthly Salary. It is the first input field on the tool. - Then, choose one among two (2) membership types - Employed or Self-Employed/Individually Paying.

- Lastly, click the

Calculateblue button to get the results.

PhilHealth Contribution Calculator Results

In the calculator, the computation results are displayed at the lower part of the tool titled with Computation Result.

The first output represents the Employer Share if you are employed. If you are not

employed, this outputs not applicable.

Then the next one is the Employee's Share, the worker. Again, this will show

not applicable if you are an individually paying member.

The last output is the Total Contribution. Whether you are an employee or an

individually paying member, this should be the total contribution to be paid to PhilHealth.

PhilHealth Contribution Computation

If you are an employee, you're going to split the payment with your employer 50/50. This means that if your salary is ₱15,000, the contribution rate for that is pegged at 5%. Considering this, your contribution is ₱750.

However, since you are employed, your employer is obliged to pay half of it which is ₱375. You'll pay ₱375 as well. It is commonly deducted before you receive your net pay for the month.

On the other hand, if you are a self-employed or individually paying member, you'll have to shoulder 100% of the contribution amount based on your income. Say you earn ₱25,000 a month; your contribution is ₱1,250.

For more reference, check out this PhilHealth Contribution Table 2025